-

Articles

Regulations on an Initial Public Offering to be listed on the LiVE Exchange: a new secondary market for SMEs and Startups

As mentioned in our previous Article, LiVE Exchange: Stock Market for SMEs and Startups [1] the Stock Exchange of Thailand (“SET”) and the Securities and Exchange Commission (“SEC”) plan to launch the "LiVE Exchange", a new secondary market especially for small and medium enterprises (“SMEs”) and startup companies (“Startups”). In such regard, on 29 December 2021, the SEC issued the Notification of the Capital Market Supervisory Board No. TorJor. 71/2564 (“the Notification”) - to regulate the offering of newly issued shares by a public limited company, either an SME or Startup, which will be subsequently listed on the LiVE Exchange as well as the offering of its securities thereafter - which came into effect as of 16 January 2022.

Fundraising through the LiVE Exchange is a viable alternative for SMEs or Startups to raise funds by offering their shares to specific investors, as stipulated in the Notification. In such regard, the conditions for such fundraising will be more lenient than other secondary markets because a company is not required to seek approval from the SEC, but it still must submit a registration statement and draft prospectus ("filing").

According to the Notification, the criteria for a company’s initial public offering of its newly issued shares to be subsequently listed on the LiVE Exchange are as follows:

A. Conditions to offer newly issued shares

A company shall be deemed to be authorised by the SEC to offer its newly issued shares if it complies with the following conditions:

1. Characteristics of a company The initial public offering of a company’s shares can be implemented if the company falls under the following characteristics:/p>

(i) It is a public limited company established under Thai law.

(ii) Its directors and executives are persons named on the whitelist of the SEC.

(iii) Its financial statements for the latest fiscal year; the first six months of which prior to submitting the filing shall be accurate, reliable and comply with the following criteria:

- Prepared in accordance with financial reporting standards;

- Audited or reviewed from an auditor which is on the list approved by the SEC; and

- The report shall be prepared and disclosed in accordance with financial reporting standards, in which the auditor must not be scoped in order to review or audit such report.

(iv) It has no history of violating material rules or conditions regarding an offer of securities, and has never been rejected by the SEC to offer newly issued shares for sale.

(v) Its business operations shall have the following characteristics:

- Not involved in a business that severely violates any laws, e.g. human trafficking, drug production or distribution, or money laundering;

- Its operation is not performed in a manner that violates or fails to comply with any legal provision which could cause a serious and significant impact on the company's business; and

- It must not be an investment company.

2. Characteristics of investors

The newly issued shares must be offered to specific investors as set forth in the annex to the Notification, for example:

(i) Institutional Investor (II)

(ii) Private equity (PE) or Venture Capital (VC)

(iii) Persons with an existing relationship with the company in the following manners:

- Directors, executives or employees of the company;

- Major shareholders; and

- Subsidiaries or associates.

(iv) Persons with experience and expertise in investment, including the following:

- Fund managers or derivatives investment managers;

- Investment analysts approved by the SEC; and

- Angel investor.

(v) High Net Worth investor (HNW) or Ultra High Net Worth investors (UHNW) which have complete qualifications regarding knowledge, experience and/or financial position according to the Notification.

3. The total offering value is not less than Baht 10 million but not exceeding Baht 500 million.

B. Filing

Prior to selling the shares publicly to the specific investors as mentioned above, the company shall submit the filing and comply with the following procedures:

(i) Prior to offering the shares, the company shall submit a registration statement and draft prospectus in accordance with Form 69-SME-PO attached to the annex of the Notification, along with other required documents to the SEC. In such filing, all directors of the company shall certify the accuracy and completeness of the information contained in such filing, and submit the original, signed version to the SEC.< /br> (ii) The filing will come into force after 14 days from the date on which the following actions have been completed:

- The company allows investors to inquire about their occurred doubt and has answered to such inquiries (“public hearing”) through the system of the SET for a period of 30 days;

- If the company has updated its latest financial statements, it shall amend the registration statement (to show its latest financial statements) and set up another public hearing in order to answer additional investors' inquiries through the system of the SET for a period of seven days; and

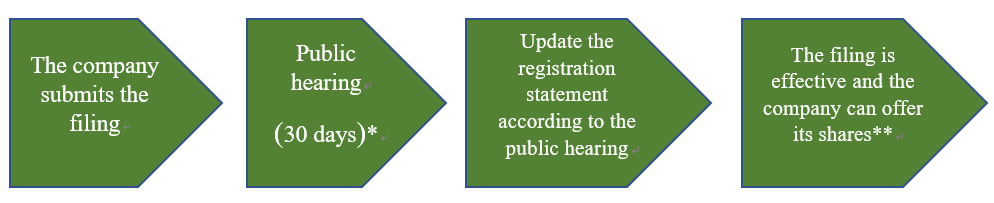

- The company has updated its latest registration statement in accordance with the information received from said public hearing. Such procedures can be visualised as follows:

* The company shall provide another public hearing for seven days in case the company updates its financial statement.

** When the company completes its update of the registration statement, the cooling-off period (14 days) can be commenced whenever the company is ready, but not later than 30 days from the date of the public hearing. After such cooling-off period, the filing shall be effective.

(iii) After the filing is effective, the company shall introduce and offer for sale its shares through a securities underwriting company. At the end of the offering period as specified in the registration statement, if it appears that the total subscription value is less than 80 percent of the total offering value, the authorisation of the offering shall be terminated, resulting in the company having to cancel its entire offering and the securities underwriting company refund all of the received subscription fees to the subscribers. In such regard, the subscription value of such shares shall be inclusive of the subscription of cornerstone investors (in the context of IPOs, the term 'cornerstone investors' is generally understood to refer to that class of investors, e.g. II, securities companies, who commit in advance to invest a fixed amount of money, or for a fixed number of shares, in an IPO). In addition, the company shall completely sell its shares and register the increase of its paid-up capital according to such sales within six months from the effective date of the filing; otherwise, the authorisation will also be terminated. These are the conditions for either SMEs or Startups to initially offer their shares in order to be subsequently listed on the LiVE Exchange according to the Notification issued by the SEC. In this regard, rules, regulations or notifications of the SET regarding the LiVe Exchange, a continuation to this Notification, specifying the rules regulating the listing of shares on the LiVe Exchange and its trading, are currently being considered, and are expected to be effective as of the first quarter of 2022. Please note that we will keep you promptly updated as and when there are any upcoming rules and regulations regarding the LiVE Exchange from any relevant agencies.

This is intended merely to provide a regulatory overview and not to be comprehensive, nor to provide legal advice. Should you have any questions on this or on other areas of law, please do not hesitate to contact:

Nuttaros Tangprasitti

Partner

Krid Pongprapaphan

Attorney-at-Law

1 Please visit Article:LiVE Exchange: Stock Market for SMEs and Startups

Nuttaros Tangprasitti specialises in corporate and commercial law. She regularly assists both international and domestic corporate clients (limited liability companies and partnerships, stock corporation in several industries) on the relevant laws of Thailand, which includes foreign direct investment, legal due diligence, M&A and cross-border M&A, joint venture, compliance, banking and finance. In addition to supporting clients on the above and a multitude of different legal formalities, she also has expertise in advising on various investment promotion policies of the Board of Investment (BOI), as well as compliance with foreign business, other laws on salient points for shareholders and joint venture agreements, which includes laws on immigration and foreign work under Thai law. Nuttaros speaks at many seminars and takes an active role in educating the clients on issues relevant to their businesses and her practice areas. She also writes various articles and newsletters on cutting-edge topics in several legal areas, which are widely distributed to existing and potential clients. Nuttaros aims to ensure the lawyers on her team are constantly developing and upgrading their skills, to ensure they meet or exceed the high professional standards of Nishimura & Asahi. She is committed to ensuring that both she and our firm deliver top-quality services to our clients and strong internal support for our colleagues. She recently began drafting a manual on several aspects of Thai law, as part of an “Investment promotion scheme,” and also wrote several newsletters on corporate law, and banking and finance laws. She also recently authored an article on the impact of Tax Reduction for Land and Buildings, which received excellent feedback from our clients, particularly those who are land and building owners. Nuttaros is committed to building a strong and progressive corporate and commercial practice, which also incorporates tax law, by adapting to new ideas in the legal industry.