Cross-border Restructuring

Covering All Aspects and Nuances in Cross-Border Restructuring and Insolvency

Due to the globalization of the world economy, it is common for Japanese corporations to have foreign subsidiaries and affiliate companies in a business group, as well as important assets such as manufacturing facilities or assembly lines abroad. In order to liquidate or reorganize a Japanese corporation in financial difficulty, it is now more common, if not the norm, to face the handle challenges regarding the debtor companies' overseas operations, subsidiaries and affiliates, which may include, among other things, the need to consider the application of not only insolvency and restructuring frameworks in Japan but also out-of-court workouts and/or formal in-court insolvency proceedings in foreign countries, either for the debtor itself and/or for its subsidiary or affiliate operating overseas; or the need to resolve certain business issues through foreign litigation proceedings, or negotiate out-of-court workouts with stakeholders.

The cross-border restructuring practice team at Nishimura & Asahi has extensive expertise and experience in numerous cross-border insolvency and restructuring cases and has represented not only debtor companies but also foreign creditors or sponsors in various insolvency and restructuring cases involving global and Japanese corporations. Depending on the case, the team will collaborate with specialist attorneys in other practice areas such as M&A, corporate, finance, international litigation and arbitration to ensure we perfectly tailor our services to our clients’ needs.

Recent Work

-

- 2022

- AirAsia Aviation Ltd. - Fund raising and group restructuring of AirAsia’s business in Thailand

-

- 2021

- Providing legal advice to a credit facility provider in relation to MTGOX’s civil rehabilitation plan

-

- 2020

- Restructuring of an LCC during the COVID - 19 pandemic

-

- 2018

- Corporate reorganization of Japan Drilling Co., Ltd. and Japan Drilling (Netherlands) B.V.

-

- 2018

- Nishimura & Asahi secures victory for creditors in Mt. Gox bankruptcy

-

- 2018

- Toshiba Corporation: Sale of Westinghouse claims for US$2.16 billion

-

- 2017

- Toshiba Corporation - US$5.3 billion capital raise via a third-party allotment

-

- 2015

- Representing a major creditor in the Skymark civil rehabilitation proceedings

Awards & Rankings

-

Nishimura & Asahi is a premier law firm in Japan with proven strength in tackling civil rehabilitation, out-of-court workouts and turnarounds. Possesses extensive experience in cross-border filings, especially in relation to US regulations. Notably acts for both creditors and debtors, with an emphasis on recapitalisation and restructuring procedures.

Chambers, Restructuring/Insolvency (2022) -

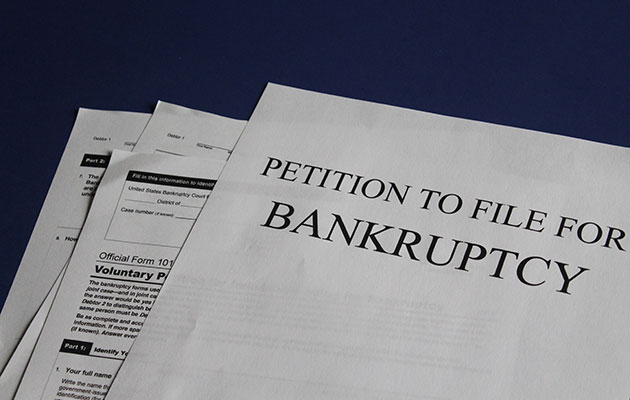

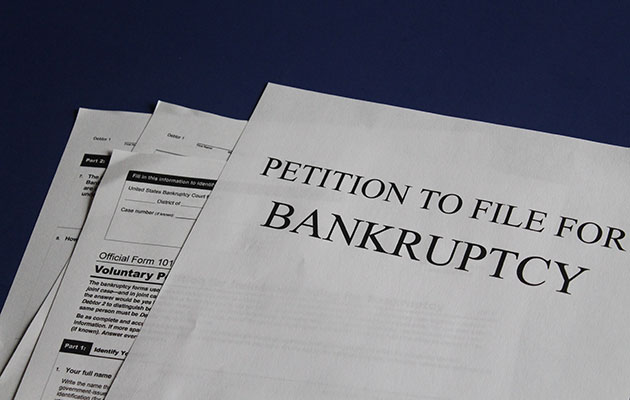

Known for traditional insolvency work, particularly representing debtors, Nishimura & Asahi is also strong in restructuring and insolvency transactions involving out-of-court workouts and turnarounds. As well as acting in large-scale matters, the firm handles petitions for bankruptcy and insolvency proceedings on behalf of small and medium-sized companies. The practice is active in Japan and throughout Asia, with increasing experience in cross-border workouts and global restructuring.

The Legal 500, Restructuring and Insolvency (2022)

Seminars

Publications

-

New Regime Incorporating Majority Vote Mechanism into Out-of-Court Workout

Articles

-

Chambers Global Practice Guides - Insolvency 2024: Japan

Articles

-

Practical Guidelines for Business Revitalization of Small and Medium Enterprises: From Procedures, Planning, Negotiation and Taxation to Consolidation of Guaranteed Liabilities

Books